SaveMore

Getting Danish youth motivated to start saving and investing

Although we probably don’t want to admit it, we humans are bad at making the right choices. This is clearly seen when you look at the success rates for the complex choices we face in life, such as choosing the right career, mortgage or partner. Even when we are faced with seemingly simple choices, for example choosing what groceries to buy for the rest of the week, we find it difficult to navigate between the many millions of combinations of shopping items that a supermarket offer. Do we always stick to our budget? Do we always choose the healthy choice? Are we able to predict what we want to eat on Wednesday without being influenced by what we want here and now? Unlikely. This project, in collaboration with Nordea, attempted to provide a smart-investing and savings solution for a specific Nordea-provdid persona, the “Time saver”.

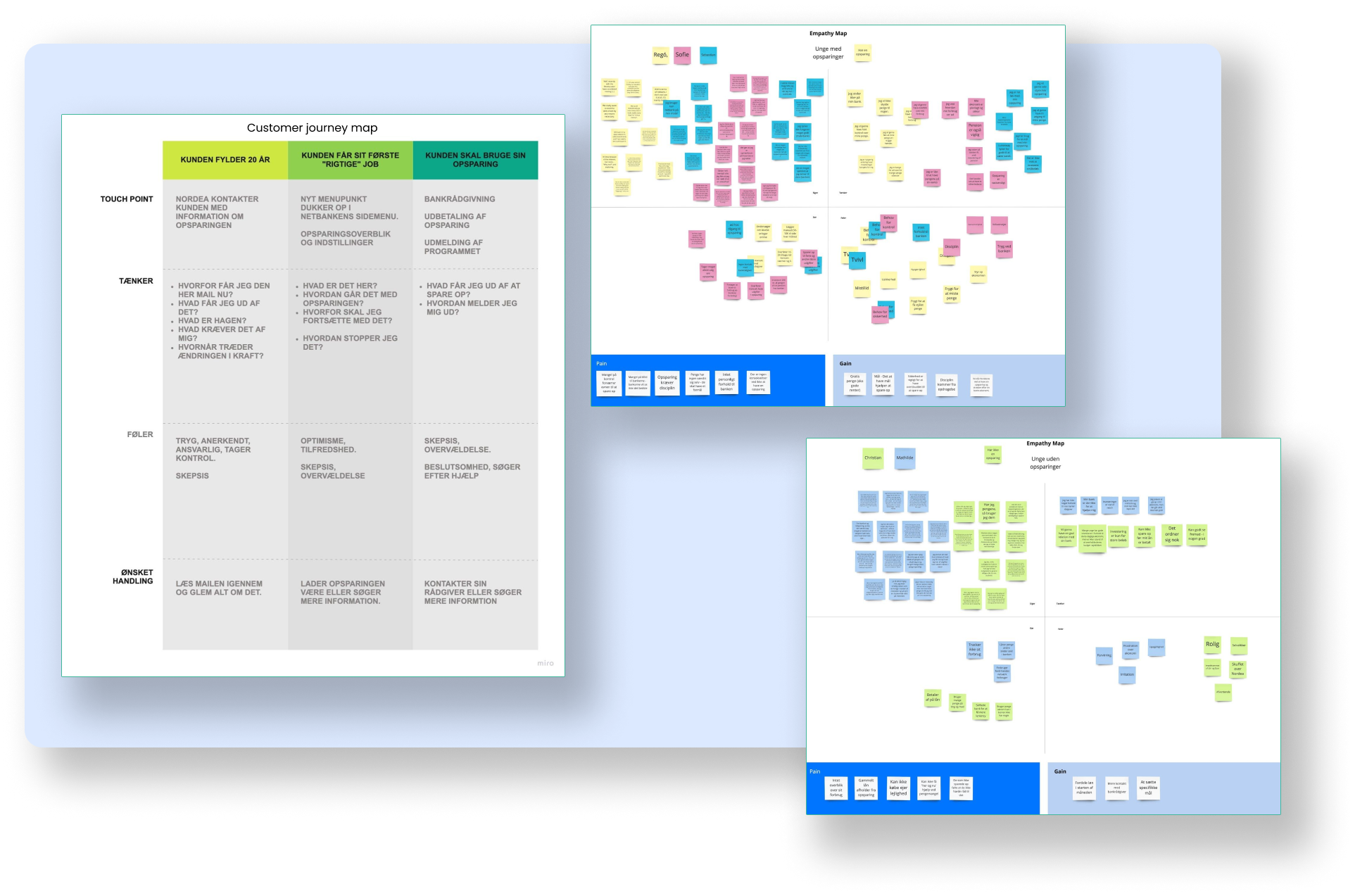

By employing concepts from behavioral economics, while conducting interviews, utilizing cultural probes, emapthy maps, customer journey maps and prototyping tools it was possible to gauge and analyze the daily spendings of a group of participants that fit the provided persona. it was shown that 50% of the participants underestimated their daily spendings.

In designing the prototype 3 key factors, both present in the existing research and collected data, were used to inform the design.

Inertia, Loss aversion and Present bias

Inertia

People are generally better at not taking a stand, which has consequences for the “default settings” our society has. This is exemplified in a study in which the number of organ donors in EU member states is compared (Johnson & Goldstein, 2003). Here it is described how the difference between, for example, Germany and Austria is respectively 12% in Germany and 99.8% in Austria. Default really do matter.

Loss aversion

Loss aversion describes the tendency for people to value loss significantly heavier than gains. Loss aversion affects savings because households quickly adjust to a certain level of disposable income. This means that saving quickly feels negative as it impacts the ‘here and now’, even though nothing is really lost.

Present bias

Present bias describes people’s tendency to overestimate their own motivation and effort with regards to the future. Studies show that people tend to make the healthy choice for the future. Most often, however, there is an immediate reward in the unhealthy choice in the present, which results in this being the most attractive thing when faced with the choice in a real situation.

The Prototype

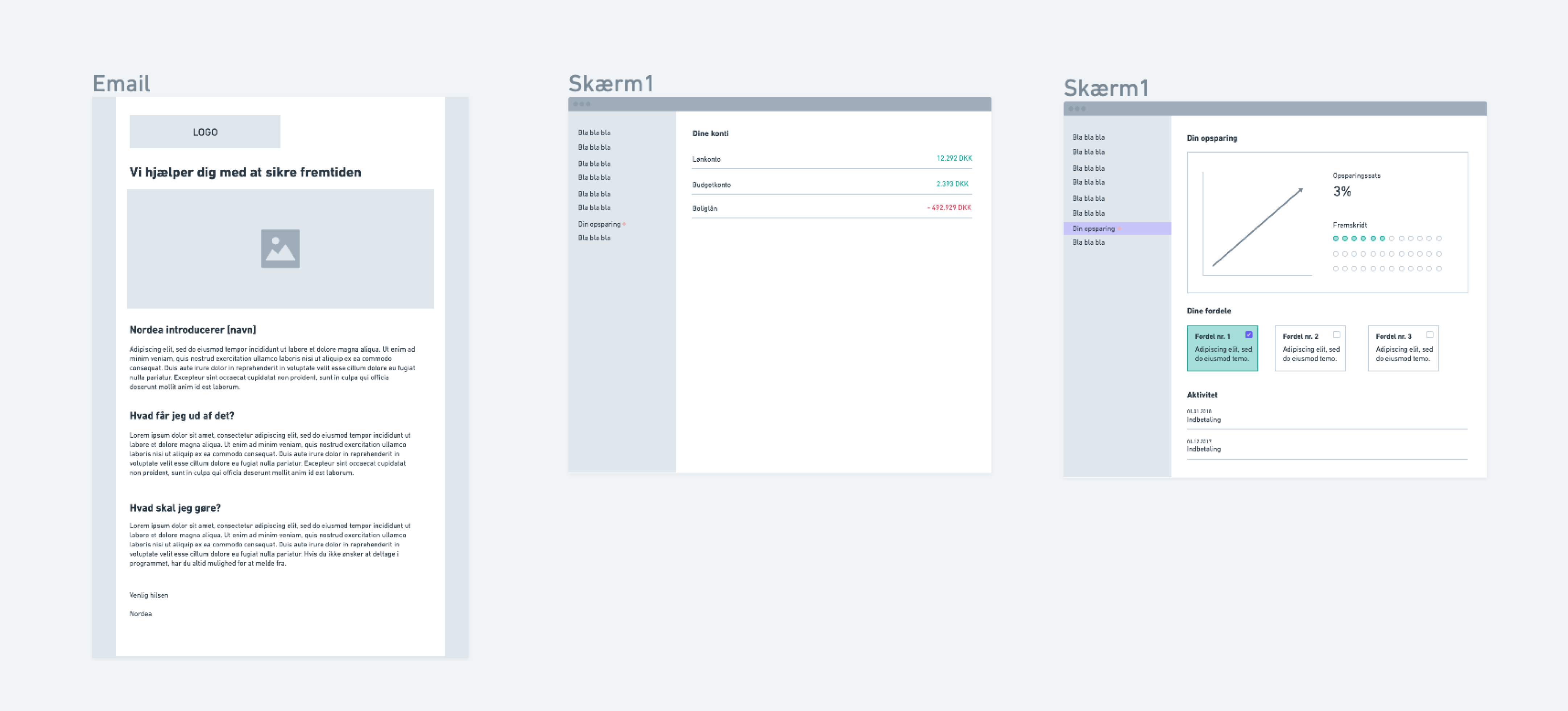

The prototype targeted both the current mobile experience, and a new flow to showcase how users might go about creating savings accounts for specific goals, such as a new bike, a vacation or something else.

The High Fidelity Prototype

In accordance with the findings from the initial stages of the project, it was important to hide the progress of the savings account, in order to mitigate loss aversion and also reduce the temptation of withdrawing ones saving before the disired goals were reached. It was even discussed to remove the possibility to interact with the savings account from witin the app, to reduce the convenience of moving money back from a SaveMore savings account.

This functionality would then only be avalible from the webpage, where rewards for continued investing would also be a motivating factor in not disabling ones savings.